davis county utah sales tax rate

Average Sales Tax With Local. Davis County Admin Building 61 South Main Street Room 105 Farmington Utah 84025 Mailing Address Davis County Treasurer PO.

Davis County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

89 rows This page lists the various sales use tax rates effective throughout Utah.

. 61 South Main Street Farmington UT 84025. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. UTAH CODE TITLE 59 CHAPTER 12 - SALES USE TAX ACT.

Real Property 801 451-3249. Has impacted many state nexus laws and sales tax collection requirements. May 19th 2021 1000 am - Pre-registration starts at 900 am.

Yearly median tax in Davis County. The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. With local taxes the total sales tax rate is between 6100 and 9050.

UT Sales Tax Rate. Tax Rates Subject to Streamline Sales Tax Rules OTHER TAXES APPLY TO CERTAIN TRANSACTIONS Rates In effect as of July 1 2021 Please see instructions below. 1 State Sales tax is 485.

3 rows Davis County. Davis County sales tax. Estimated Combined Tax Rate 725 Estimated County Tax Rate 180 Estimated City Tax Rate 010 Estimated Special Tax Rate 050 and Vendor.

Fax Hours Monday Friday 800 am. 7705 or email to taxmasterutahgov. Davis County Admin Building 61 South Main Street Room 105 Farmington Utah 84025 Mailing Address Davis County Treasurer PO.

Sales Tax and Use Tax Rate of Zip Code 84010 is located in Bountiful City Davis County Utah State. The median property tax in Davis County Utah is 1354 per year for a home worth the median value of 224400. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other publications found here.

4 State Sales tax is 485. The Utah state sales tax rate is currently. Fax Hours Monday Friday 800 am.

Falcon Hill Davis a 06-300 675 300 1132 775 1625 Falcon Hill Clearfield a 06-301 675 300 1132 775 1625 Falcon Hill Sunset a 06. 06 of home value. Estimated Combined Tax Rate 725 Estimated County Tax Rate 180 Estimated City Tax Rate 000 Estimated Special Tax Rate 060 and Vendor Discount 00131.

Estimated Combined Tax Rate 725 Estimated County Tax Rate 165 Estimated City Tax Rate 000 Estimated Special Tax Rate 075 and Vendor Discount 00131. Fax Hours Monday Friday 800 am. Davis County 06-000 485 100 025 025 025 025 025 005 715.

Box 618 Farmington Utah 84025 Phone Numbers 801 451-3250. See Publication 25 Sales and Use Tax General Information. Select the Utah city from the list of popular cities below to see its current sales tax rate.

Some cities and local governments in Davis County collect additional local sales taxes which can be as high as 88817841970013E-16. Box 618 Farmington Utah 84025-0618 Phone Numbers 801-451-3243. Davis County collects on average 06 of a propertys assessed fair market value as property tax.

The 2021 Davis County Delinquent Tax Sale will be held. Sales Tax and Use Tax Rate of Zip Code 84014 is located in Centerville City Davis County Utah State. You may also call the Tax Commission at 801 297-7705 or toll free at 1-800-662-4335 ext.

The various taxes and fees assessed by the DMV include but are. 10 rows The Davis County Sales Tax is 18. Utah has state sales.

State Local Option. The current total local sales tax rate in Davis County. Sales is under Consumption taxes.

Sales is under Consumption. Box 618 Farmington Utah 84025-0618 Phone Numbers 801-451-3243. Sales Tax and Use Tax Rate of Zip Code 84315 is located in Hooper City Davis County Utah State.

To review the rules in Utah visit our state-by-state guide. Davis County Administration Building Room 131. The Davis County sales tax rate is.

The 2018 United States Supreme Court decision in South Dakota v. Davis County Admin Building Assessors Office Room 302 61 South Main Street Farmington Utah 84025 Mailing Address Davis County Assessors Office PO. Davis county admin building 61 south main street room 105 farmington utah 84025 mailing address davis county treasurer po.

Falcon Hill Davis a 06-300 690 300 1147 790 1640 Falcon Hill Clearfield a 06-301 690 300 1147 790 1640 Falcon Hill Sunset a 06. Utah has 340 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. 84089 zip code sales tax and use tax rate Clearfield Davis County Utah.

Sales Tax and Use Tax Rate of Zip Code 84089 is located in Clearfield City Davis County Utah State. The various taxes and fees assessed by the dmv include but are. 2 State Sales tax is 485.

Personal Property 801 451-3134. Utah is ranked 964th of the 3143 counties in the United States in order of the median amount of. A county-wide sales tax rate of 18 is applicable.

Automating sales tax compliance can help your business keep compliant with changing. 1 State Sales tax is 485. Utah has recent rate changes Thu Jul 01 2021.

The state sales tax rate in Utah is 4850. Utah state sales tax. A county-wide sales tax rate of 1 is applicable to localities in Davis County in addition to the 6 Iowa sales tax.

Estimated Combined Tax Rate 725 Estimated County Tax Rate 180 Estimated City Tax Rate 000 Estimated Special Tax Rate 060 and Vendor Discount 00131. Properties may be redeemed up to the time of sale. To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824.

Davis County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

District News Davis School District

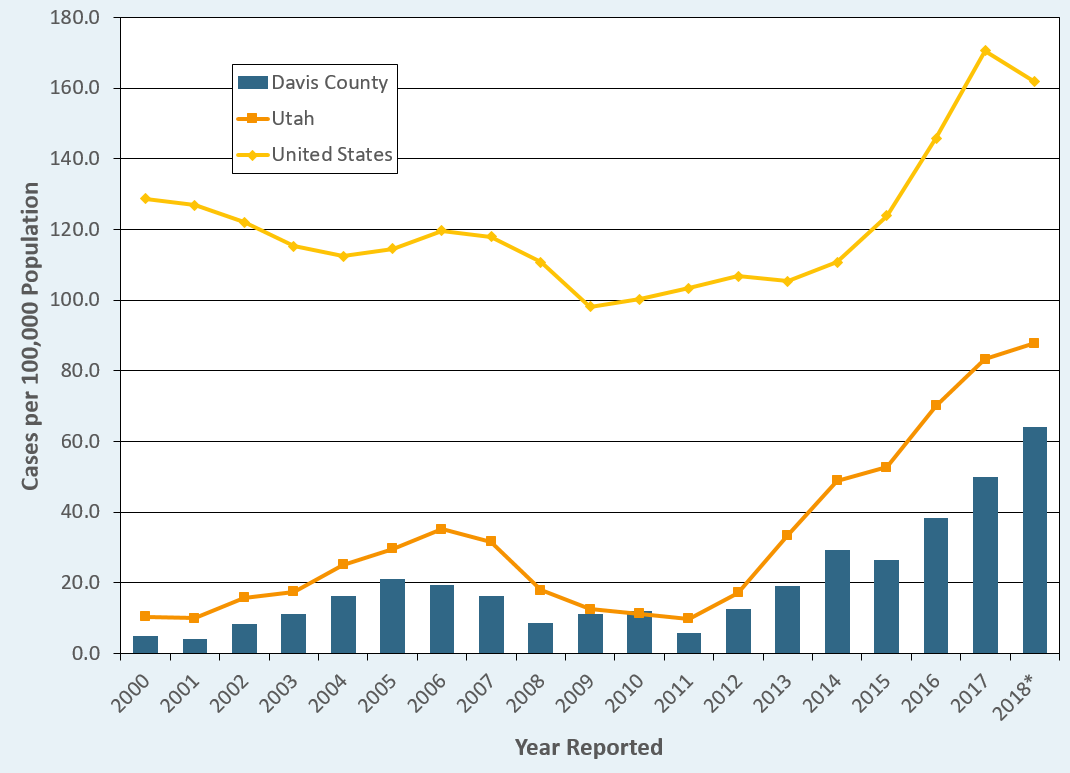

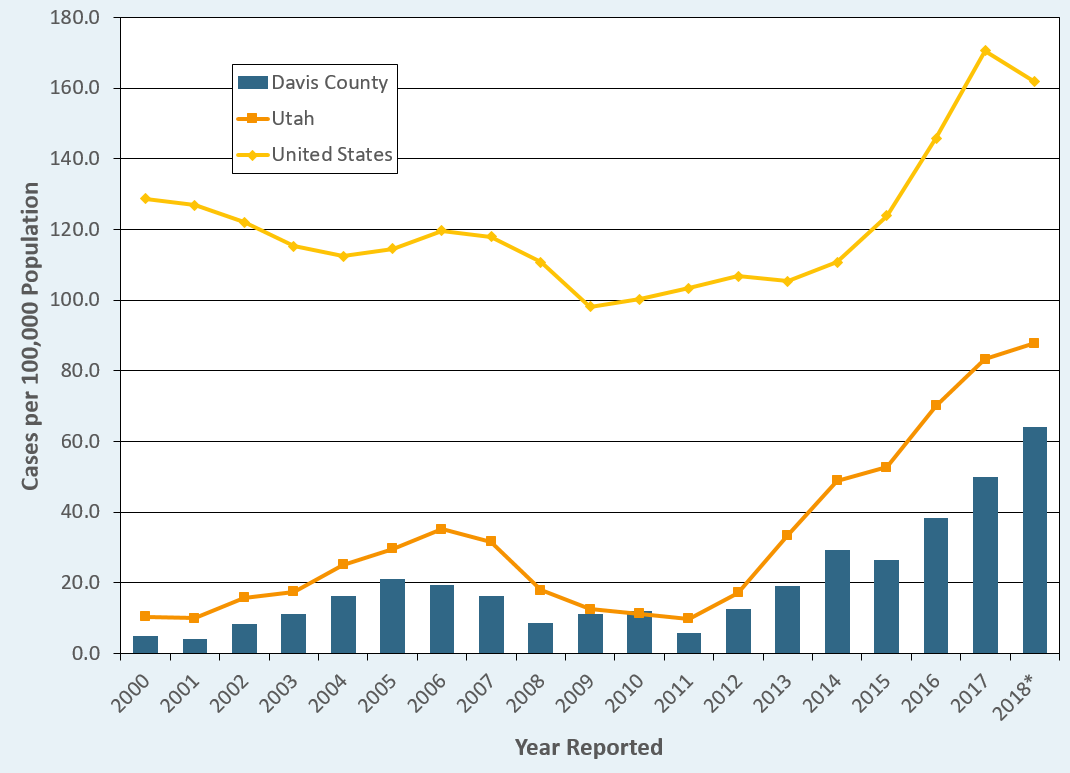

Sexually Transmitted Disease Highlights

Davis County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Davis County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Best Places To Live In Davis County Utah

Davis County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More